BD grows Q2 revenue despite COVID-19 test dip, spins off diabetes business

Dive Brief:

- Becton Dickinson on Thursday reported fiscal second-quarter revenues of $4.9 billion, an increase of 15.4% over the prior-year period driven by coronavirus testing sales of $480 million, far below Evercore ISI analyst expectations of $550 million.

- Resurgences of COVID-19 infections during the quarter in the U.S. negatively impacted BD’s surgery and peripheral intervention units. Still, BD reiterated its fiscal 2021 guidance and expects revenues to grow 12% to 14% on a reported basis for the full year, which assumes no significant change in utilization or procedure volumes related to coronavirus.

- BD also announced on Thursday that it will spin off its diabetes care unit, which had fiscal 2020 revenues of $1.1 billion. The transaction for the separate publicly traded company is expected to be completed in the first half of calendar year 2022 and will not impact BD’s ability to fulfill its orders related to vaccinations.

Dive Insight:

BD continues to benefit from global sales of syringes relating to COVID-19 vaccination efforts. The company’s medical segment brought in second-quarter revenue of $2.3 billion, an increase of 7.4% versus the prior-year period, fueled by medication delivery solutions (MDS) growth.

CFO Chris Reidy told investors MDS growth was 8.1%, helped by U.S. sales of catheters and medication delivery devices as well as international revenue growth due to a favorable comparison to the prior-year quarter, which was impacted by pandemic-related declines in China.

BD’s interventional segment, driven by the surgery and peripheral intervention businesses, reported flat revenue in the second quarter on a currency-neutral basis. However, Reidy told investors the results were “better than expected” given the resurgences of COVID-19 infections during the quarter, adding that the company “did see recovery in elective procedures as the quarter progressed and this trend has continued into April.”

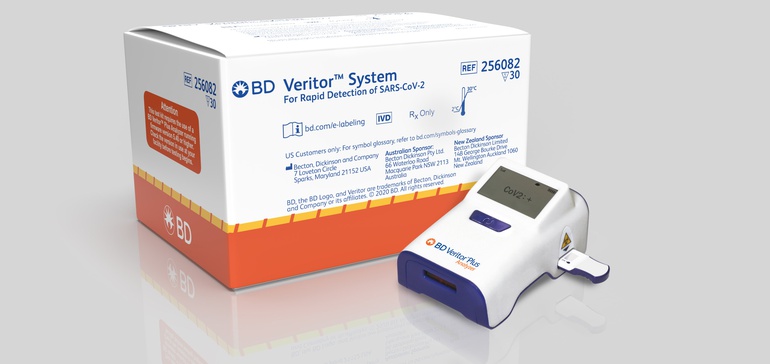

On the coronavirus testing front, Reidy said COVID-19 diagnostics revenues totaled $480 million, with BD’s Veritor Plus rapid antigen test bringing in $290 million.

“The market’s overall demand for symptomatic COVID diagnostic testing was lower,” the CFO acknowledged.

SVB Leerink analysts in a Thursday note said BD’s COVID-19 diagnostic testing underperformed in the quarter which was “not entirely surprising given other COVID testing players’ results.” Coronavirus-related sales at other diagnostic companies such as Abbott Laboratories and Quidel have fallen short of analyst expectations in recent financial updates.

Growth in BD’s Integrated Diagnostic Solutions unit was “unfavorably impacted” by the lack of a traditional influenza season in early 2021. However, CEO Tom Polen told investors Thursday that combination COVID-influenza tests “are going to be important in the next flu season.”

The company announced in late March that it was granted an FDA emergency use authorization for a rapid antigen test that can detect SARS-CoV-2, influenza A and influenza B.

The company last month also received an EUA for its Veritor Plus rapid antigen test to be used for COVID-19 screening through serial testing of asymptomatic individuals. BD is also continuing to develop an at-home Veritor diagnostic that works with smartphones and digitally shares results.

Polen over the past year has emphasized that BD’s troubled Alaris infusion pump system has been his top priority. On Thursday, he touted the fact that BD last week filed a new 510(k) submission for Alaris, which over the past year has been plagued by multiple software and hardware recalls.

The medtech originally planned to file the FDA application by the fourth quarter of 2020, but challenges from the COVID-19 pandemic forced the company to push back the timeline. Polen told investors on Thursday that the 510(k) submission is comprehensive, bringing Alaris up to date for all changes to the pump, including addressing open recall issues through a new version of software that will provide clinical, operational and cybersecurity updates.

“We believe it would be prudent to think about Alaris’ clearance sometime during the second half of our fiscal year 2022,” the CEO added.

BD reported that second-quarter revenues for its Diabetes Care unit were comparable to the prior-year period, which benefited from increased U.S. orders from retailers and distributors in response to the COVID-19 pandemic.

Polen said that by spinning off BD’s diabetes unit into a separate public company the medtech will be able to leverage its global leadership position in insulin delivery and “unleash” the market’s high-growth potential “through the more efficient allocation” of capital and by allowing each company to pursue their strategic goals.

“This transaction allows us to focus on our prioritized core businesses,” added Polen, who said management expects the spinoff to strengthen its mid-single-digit revenue growth and double-digit total return growth profile.

Devdatt Kurdikar, currently worldwide president of BD Diabetes Care, will become CEO of the spinoff.

SVB Leerink analysts noted that BD’s diabetes care business has played a “leading role in driving the adoption of insulin syringes/pens combined with pen needles as the leading modality for insulin injection.” The analysts also pointed to BD as the “leading producer” of diabetes injection devices, making approximately 8 billion injection devices annually and serving about 30 million patients.